In a decisive move to bolster the economy, the Federal Reserve has announced a 0.5% interest rate cut today. This change represents a significant moment for the solar industry, promising new opportunities for homeowners, contractors, and financiers. With the potential for lower costs, increased adoption of solar technology, and a more vibrant market, we aim to explore the implications of this development for the solar sector.

Significance of the Federal Reserve Rate Cut for the Solar Industry

1.

Impact on Solar Financing

Lower Borrowing Costs for Homeowners

The cut in interest rates will likely lead to lower borrowing costs, especially for solar loans. Homeowners looking to invest in solar energy systems can benefit from reduced interest rates, making solar installation more financially accessible. This accessibility is pivotal for driving the growth of residential solar installations across the United States.

Expected Reduction in Dealer Fees

As the financing landscape changes, many financing companies may reduce dealer fees by 3-4%. This decline in fees can lower the overall cost of solar installations, incentivizing more homeowners to opt for solar energy systems. As contractors benefit from these savings, they’re likely to close more deals, amplifying the reach of solar energy solutions.

2.

Enhanced Competitiveness of Loan Products

Loan Products vs. Third-Party Ownership

If the Fed proceeds with another 0.5% rate cut in the coming months, we may see an additional 3-4% reduction in dealer fees. This could make loan products significantly more appealing than third-party ownership (TPO) options. Homeowners might increasingly favor purchasing their solar systems outright, thus stimulating the market further and providing contractors with increased sales opportunities.

3.

Current Trends in Solar Product Pricing

Rising Costs Due to Import Tariffs

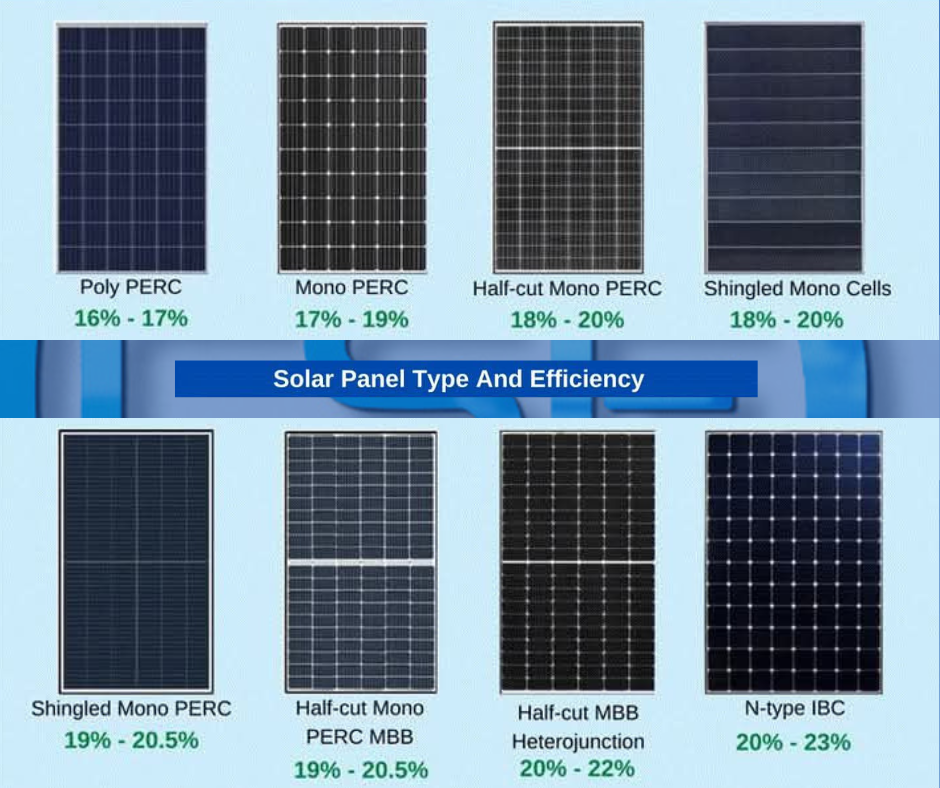

Our conversations with over 40 manufacturers, finance companies, and supply chain vendors suggest that prices for both residential and commercial solar panels are expected to rise into the high 20-cent range due to impending import tariffs. While this could deter some potential buyers, homeowners should consider maintaining a small stock of Tier 1 panels priced below 20 cents, as this tier is typically approved by most financing companies’ approved vendor lists (AVL).

Competitive Pricing for U.S.-Assembled Panels

On a positive note, prices for U.S.-assembled solar panels are expected to become more competitive with those of non-U.S.-assembled panels, primarily due to government incentives supporting local manufacturing. However, contractors and homeowners should note that neither U.S.-nor non-U.S.-assembled panels currently qualify for the additional **10% tax credit under the Inflation Reduction Act (IRA), which could impact their financing decisions.

4.

Market Stability and Component Pricing

Stabilization of Inverter, Racking, and BOS Prices

The stability of prices for essential components, such as inverters, racking, and balance-of-system (BOS) supplies, is a welcomed development. The current supply chain normalization enhances project predictability and provides homeowners with a clearer understanding of their total installation costs.

Decreasing Battery Prices

As the solar landscape evolves, battery prices—a critical component of solar energy systems—are projected to decrease due to falling raw material costs for lithium iron. This decrease will bolster the appeal of solar-plus-storage systems, which can offer enhanced energy independence and reliability for homeowners.

5.

Long-Term Prospects for the Solar Industry

Brighter Future for Solar Energy

With the economic climate shifting favorably, it appears that the solar industry’s “worst times” may be behind us. A multitude of factors, including falling borrowing costs, competitive product pricing, and an enhanced consumer appetite for solar technology, are poised to stimulate the growth of the solar market.

Government and Regulatory Support

Continued government support and regulatory encouragement will play a crucial role in maximizing the potential benefits of the Federal Reserve’s decisions. If policymakers remain committed to renewable energy and sustainability initiatives, the solar sector can expect to flourish, driving innovation and investment in solar technology.

Conclusion: Harnessing the Potential of Solar Energy

In conclusion, the recent interest rate cut by the Federal Reserve creates an auspicious environment for the solar industry. By reducing borrowing costs, enhancing the competitiveness of loan products, and stabilizing prices, the solar sector is positioned for renewed growth. Homeowners looking to invest in solar energy will find more attractive options, and contractors will have enhanced opportunities to expand their businesses.

Join CSE Solar USA!

At CSE Solar USA, we are committed to providing the latest insights, news, and resources to empower you in your solar journey. As the solar market continues to evolve, we invite you to stay informed and engaged with our expert content. Together, let’s harness the potential of solar energy to create a sustainable future.